Stablecoins Attract $4 Billion Inflows, Significance for Bitcoin Unveiled, crypto market trends 2024, cryptocurrency stablecoins, digital asset market, cryptocurrency market

Stablecoins are digital asset markets linked to traditional currencies. The stablecoin crypto has recently experienced an unprecedented influx. It surpassed this flow by $4 billion last month. This growth, reflected in on-chain data, raises questions. This prompts consideration of its implications for the broader cryptocurrency market, particularly Bitcoin. Read this post of ‘Best Money Market Today’ carefully to know this completely.

Stablecoin Inflows Hit Record High: Bullish or Bearish for Bitcoin?

Table of Contents

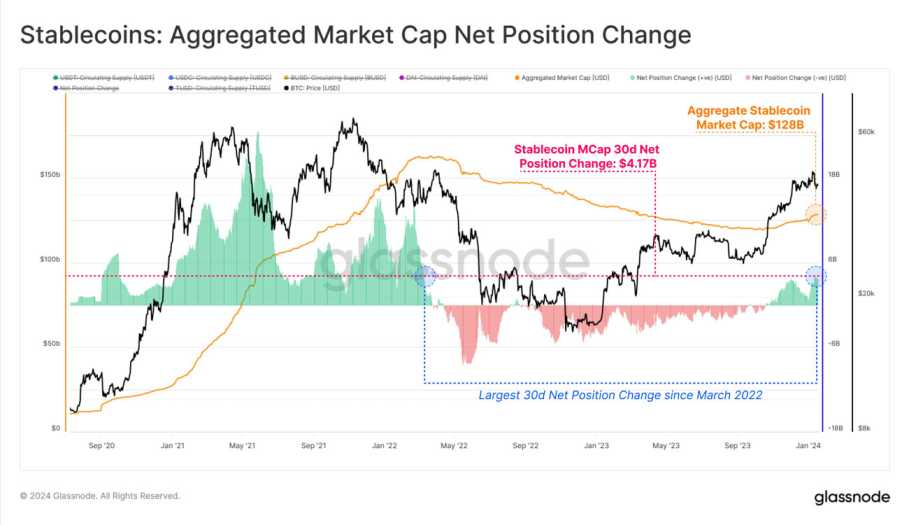

ToggleThe recent record-breaking flow of $4 billion in crypto stablecoins last month raises questions. This increase prompts an inquiry into its potential impact on Bitcoin. The surge in stablecoin crypto supply is represented by a 30-day net position change exceeding $4.17 billion. This suggests a pivotal moment in the crypto market. This flow has a dual effect. First, it could indicate a temporary flight from volatility in digital assets like Bitcoin. This contributes to increasing the stable coin supply. Second, market cap growth can direct new capital inflows. This is generally seen as a positive development. While the short-term impact may lead to a bearish trend in the Bitcoin price, the long-term outlook remains optimistic. Historical patterns indicate capital returns to volatile assets when market conditions stabilize.

Trending: How will the spot Bitcoin ETF compare to the S&P 500 ETF?

Stablecoin Market Cap Explodes: $4 Billion Inflows in One Month

The stablecoin cryptocurrency price saw an unprecedented $4.17 billion inflow last month. It is associated with traditional currency. This indicates significant growth. Glassnode reports a significant expansion in the overall supply of major stablecoins. According to various cryptocurrency news reports, this pushed the total market cap to an all-time high of $128 billion. This rise is marked by the 30-day net position change for stablecoins. This hints at potential implications for the broader cryptocurrency sector. The recent correlation between stablecoin flows and bitcoin price declines suggests a capital rotation. Despite short-term fluctuations, the long-term bullish outlook for stablecoins influencing the broader crypto landscape remains strong. This approach attracts new capital, encouraging liquidity.

Bitcoin Price Dives as Stablecoins Surge: What’s Happening?

The recent record of cryptocurrency stablecoins has prompted exploration of their impact on Bitcoin. Glassnode reports a significant increase in the overall supply of major stablecoins, marking a significant increase. An increase in stable supply correlates with a decrease in the price of bitcoin. This suggests a possible capital rotation. This movement indicates a shift from volatile assets to stablecoins. While short-term bearish effects may emerge, the long-term outlook remains positive. It’s because capital often returns to assets like Bitcoin. Bitcoin briefly fell to $40,700, only to recover and soon reach $41,400. The price fluctuations illustrate the ever-changing dynamics of the cryptocurrency market. This corresponds to the dynamic nature of the crypto landscape. This was followed by a recovery of $41,400.

Read More: Is Ledger Still a Safe Place to Store My Cryptocurrency?

Crypto Market Braces for Impact: Stablecoins Signal Bullish Future?

The crypto market is now poised for the impact of stablecoins on its future trajectory. An increase in stable coin supply, despite contributing to short-term volatility, sets the stage for a more bullish market. The increased liquidity provided by stablecoins attracts more participants. This could potentially drive the price of the cryptocurrency to new highs. The increased liquidity provided by stablecoins attracts more participants. According to various crypto news reports, this influx has the potential to push the price of the cryptocurrency to new highs.

Will Stablecoins Dethrone Bitcoin?

Experts weigh in on whether cryptocurrency stablecoins can topple Bitcoin. Stablecoins play an important role in providing stability and liquidity. Hence, Bitcoin’s status as a store of value and digital gold remains intact. Stablecoins and Bitcoins can coexist. Stablecoins can act as an on-ramp for new capital to enter the crypto market.

Cryptocurrency Trends 2024: Stablecoins Lead the Charge?

Looking ahead to this year, stablecoins emerge as leaders in driving cryptocurrency trends 2024. Their increased market cap and flow position them as key players in shaping the digital asset market landscape. As stablecoins gain prominence, their impact on digital asset market dynamics will continue to evolve. Additionally, the relationship with assets like Bitcoin will change.

Conclusion

The flow of stablecoins surpassed $4 billion last month. This presents both challenges and opportunities for the cryptocurrency market. While short-term effects may include shifting capital from Bitcoin to stablecoins during periods of market volatility, the long-term bullish potential remains strong. Crypto stablecoins can play an important role in shaping the future of the crypto market. They will coexist and complement assets like Bitcoin.

Read More: