Why did Bitcoin price drop today , When is the next Bitcoin halving, Will Bitcoin price hit $80000?

The leading cryptocurrency, Bitcoin, has recently experienced a significant downturn. Bitcoin price dropped today to $66,000. This sudden 5.6% drop sent shockwaves through the cryptocurrency market. This has prompted investors and analysts to dissect the underlying reasons behind the decline. Now many people are thinking, Why did Bitcoin price drop? In this comprehensive analysis, we will explore the contributing factors to the recent Bitcoin crash. We will examine the impact of the upcoming bitcoin halving. We will also discuss ‘When is the next Bitcoin halving’. Additionally, we will evaluate the investment potential of Bitcoin post-crash. Finally, we will provide insight into the future potential of these digital assets.

Bitcoin Price Tumbles Below $66,000: 4 Major Reasons

Table of Contents

Toggle

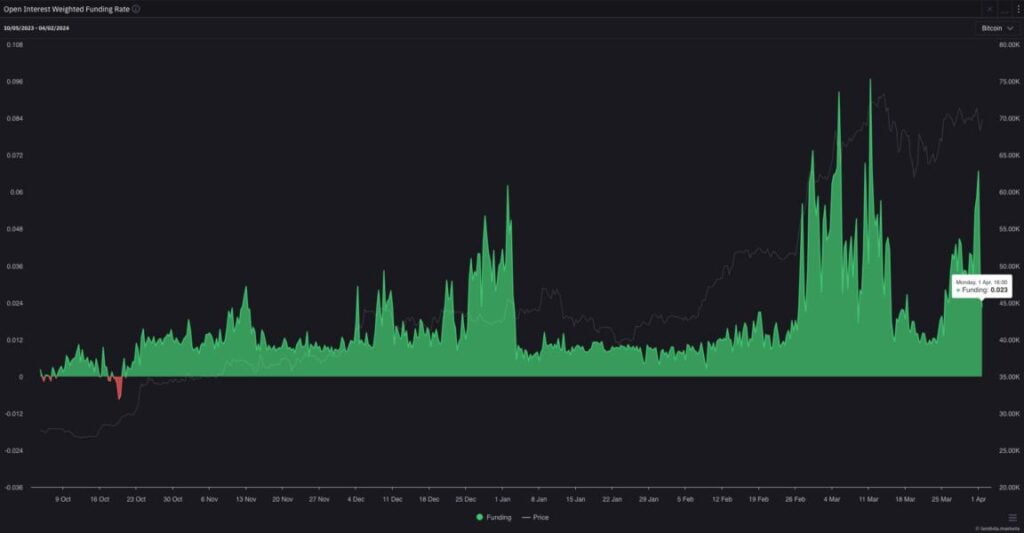

The bitcoin price drop today can be attributed to four main factors. These include long liquidations, a rising US dollar index (DXY), investor profit-taking, and Bitcoin ETF outflows. Long liquidation, characterized by the forced sell-off of long positions, contributed significantly to the price decline. This is enhanced by a high level of leveraged trading. Additionally, a strengthening U.S. dollar coupled with profit-taking activities and outflows from Bitcoin ETFs further dampened investor sentiment. These factors also contributed to the downturn in the market.

Read this: How Much Will Lovely Inu Cost in 2024?

Why did Bitcoin price drop today?

The price of Bitcoin has fallen due to a combination of factors. These factors include long liquidations, a strengthening US dollar, profit taking by investors, and outflows from Bitcoin ETFs. Due to these reasons, selling pressure has been created in the market. This resulted in a significant bitcoin price drop today.

The recent Bitcoin crash was primarily caused by long liquidations, a rising US dollar index, and investor profit-taking. Additionally, Bitcoin ETF outflows contributed to the market downturn. These factors collectively contributed to the sudden drop in the price of Bitcoin. They trigger a domino effect of selling and increase market volatility.

When is the next Bitcoin halving?

The next Bitcoin halving is due in just 18 days. This adds another layer of uncertainty to the cryptocurrency market. This predetermined event slows down the rate at which new bitcoins are created. Historically, this has had a significant impact on Bitcoin’s price and market dynamics.

Bitcoin halving refers to a process. This halves the reward for mining new blocks on the Bitcoin blockchain. It happens about every four years. This process is designed to regulate new bitcoin issuance. It also aims to maintain the scarcity of digital assets over time.

After the halving, the price of Bitcoin is expected to fluctuate significantly. Market participants will adjust as the supply of new bitcoins decreases. Historically, Bitcoin has experienced periods of volatility in both areas. It also experienced price appreciation after half the event.

Read this: How high will Brett Coin go in 2024?

Is Bitcoin a good investment after the price drop?

Despite recent price declines, Bitcoin remains a compelling long-term investment opportunity for investors. It seeks exposure to digital assets. The underlying fundamentals of Bitcoin include its limited supply and growing adoption. These suggest strong potential for Bitcoin future growth.

Now the question is: does bitcoin halving impact on price? A bitcoin halving reduces the supply of new bitcoins entering the market. This creates upward pressure on prices due to increased scarcity. This supply-demand dynamic causes prices to rise in the long run.

It is difficult to predict with certainty the exact trajectory of the Bitcoin price in the short term. However, technical analysis suggests that Bitcoin may find support at key levels, such as $61,000.

The recent price drop and heightened volatility in the Bitcoin market have caused concern. These concerns are about a potential bearish trend. However, it is essential to consider the broader market context and long-term fundamentals. These should be considered while assessing market sentiment.

#DXY ⬆️4 weeks in a row/broke out of its downtrend so consensus is that a new uptrend is starting yet risk assets are consolidating at ATH

— “Coosh” Alemzadeh (@AlemzadehC) April 2, 2024

Next move ⬆️in risk assets on deck IMO pic.twitter.com/u6ORa76vkj

Will Bitcoin price hit $80,000?

While specific price targets, such as $80,000, are speculative, Bitcoin’s historical price performance suggests further upside potential exists. This is particularly evident in the context of ongoing market development and adoption.

Key support levels for the Bitcoin price include $61,000. This level has previously served as a strong support level during periods of market volatility. Additionally, technical indicators such as the 200-period moving average can provide additional support levels for Bitcoin.

Read this: Will Shiba Inu reach 1 cent by 2030?

What are the future prospects of Bitcoin?

Bitcoin’s future prospects remain promising. This is driven by increasing institutional adoption and growing recognition as a store of value. Additionally, ongoing developments in blockchain technology contribute to its potential. Bitcoin is poised for continued growth and evolution as regulatory transparency improves. Mainstream adoption continues to expand, further cementing its position in the financial landscape.

A long liquidation in Bitcoin refers to a situation where traders with long positions are forced to sell their Bitcoin holdings. This happens due to a sudden drop in the market price. This often happens in leveraged trading environments. When the value of the long position falls below the maintenance margin requirement, it triggers a margin call. Subsequently, it increases the liquidity of the position.

The DXY, or US Dollar Index, measures the value of the US dollar against a basket of foreign currencies. A rising DXY usually indicates strength in the US dollar. This could have a negative impact on Bitcoin and other risky assets. This inverse correlation stems from investors’ preference for safe-haven assets during periods of dollar strength. This reduces the demand for risky investments like Bitcoin.