Cryptocurrency Landscape 2024: Bitcoin ETF Surge and DeFi Growth, Regulatory challenges in crypto, Bitcoin halving in April 2024

As 2023 transitions into the past, the cryptocurrency world ushers in groundbreaking developments in 2024. A landmark moment comes as the US Securities and Exchange Commission (SEC) approves 11 spot bitcoin exchange-traded funds (ETFs). This historic decision was taken on January 10. This marks a significant milestone, catapulting Bitcoin into the spotlight. After just one week of trading, it cemented its position as the second-largest exchange-traded commodity by volume. The launch of the Bitcoin Spot ETF sparked speculation. This speculation revolves around the potential of similar devices for other cryptocurrencies. In addition, the expectation of Bitcoin halving in April 2024 boosts confidence in various sectors. This expectation gives rise to optimism about potential price increases. Additionally, it fuels expectations for future price increases.Read this post of ‘Best Money Market Today’ carefully to know this completely.

How did Bitcoin ETFs impact DeFi in 2024?

Table of Contents

ToggleThe introduction of U.S. Bitcoin ETFs in January 2024 had a brief impact on the decentralized finance (DeFi) sector. While the DeFi market has experienced strong growth, exemplified by Total Value Locked (TVL) and token price increases, it has also faced challenges. The socket protocol security breach resulted in a $3.3 million theft. This incident demonstrated the vulnerability of DeFi projects and the need for strong security measures. The latter phenomenon demonstrated resilience with rapid identification and correction of vulnerabilities. Collaborative efforts resulted in the recovery of approximately 70% of the stolen funds within a week. The incident underscores the need for enhanced security measures. This underscores the critical need to strengthen security protocols within the DeFi space.

During DeFi growth in 2024, its projects are adapting to the changing landscape. They are recognizing the need for regulatory compliance as an integral aspect of their operational strategies. Ripple’s president, Monica Long, anticipates a significant shift towards DeFi compliance. This shift signals the industry’s maturation beyond the hype cycle. This points to a focus on real-world utility and sustainable integration with traditional financial systems. Despite regulatory challenges for DeFi, protocols like EigenLayer demonstrate agility and resilience. They respond dynamically to market demands, highlighting the innovative potential of the industry.

Read More: Solana Price Surges Despite Outage Concerns: Is This a Bottom Formation?

Cryptocurrency Landscape 2024: PulseChain and Sui’s Explosive Growth

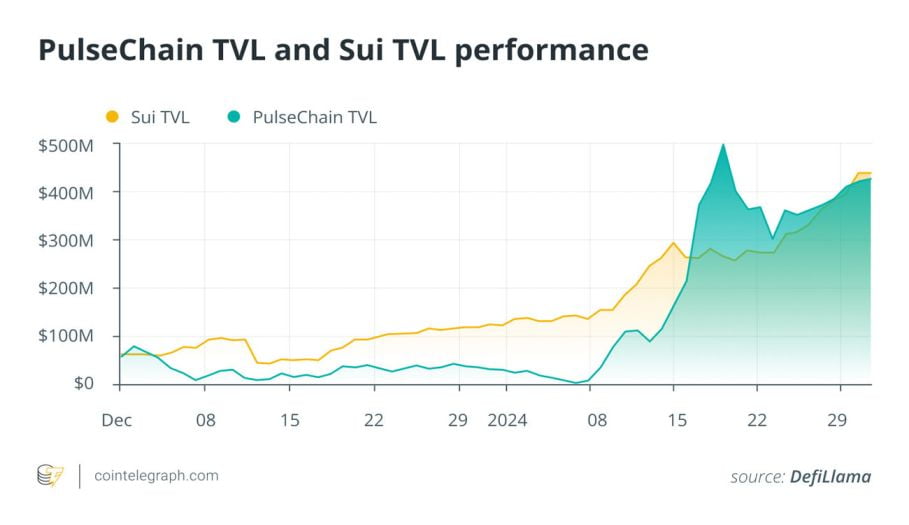

PulseChain and Sui are distinguishing themselves in the DeFi landscape with significant Total Value Locked (TVL) growth. PulseChain experienced a significant increase of 189%, while Sui experienced a significant increase of 107%. PulseChain’s growth can be attributed to two main factors. First, the expansion of its local decentralized exchange, PulseX, played a significant role. Second, the transfer of more than 20 million Dai stablecoins from Ethereum occurred in less than a week. This has further contributed to the impressive growth of PulseChain.

The growth of Sui is closely related to the popularity of lending protocols. Notably, the Navi protocol achieved a significant increase of 162%. Additionally, Scallop Lend saw significant growth with a 229% increase, further contributing to Sui’s overall success in the DeFi landscape. The opening of the second episode of Scallop Lend was a pivotal moment. This marked the beginning of its airdrop and rewards program. As a direct result, this significantly contributes to doubling the protocol’s Total Value Locked (TVL). However, sustainability remains a key question for these projects. It carries out ongoing scrutiny of their features and adoption.

Read More: Will Bitcoin Hit $1 Million by 2028?

Bitcoin Halving in April 2024 & Price Predictions

The expected Bitcoin halving is set to occur in April 2024. This phenomenon adds another layer of complexity to the cryptocurrency landscape in 2024. Industry sentiment reflects confidence in potential price increases. This is expected to be driven by the Bitcoin Halving in April 2024 event. However, forecasting price movements remains a speculative endeavor. As the industry waits to halve, it is imperative to take a critical look at the reliability of these predictions. Additionally, it is crucial to recognize the unpredictable nature of the cryptocurrency market in 2024.

Socket Protocol Exploit Aftermath

The socket protocol exploit in January underscores an important point. This emphasizes the importance of robust security measures in the DEFI space. Learning from this incident emphasizes an important point. They emphasize the need for constant vigilance and rapid response to vulnerabilities. During DeFi’s growth in 2024, its projects can increase their security by collaborating with analytics companies. Another effective strategy involves implementing proactive measures. Additionally, building a culture of cybersecurity awareness among team members and users is critical to overall risk mitigation. The incident served as a catalyst for the industry. It emphasizes the need to prioritize security and strengthen defenses against potential threats.

Read More: Can El Salvador’s Crypto Experiment Succeed?

Derivatives Market & Regulatory Challenges

In 2023, significant regulatory differences were observed globally. These differences had an impact on both the centralized exchange and the DeFi project. Regulatory challenges in crypto, especially in the derivatives market, have been prominent. These regulatory challenges in crypto have forced major industry players like Crypto.com and Binance to take strategic steps. These include scaling back operations, reducing leverage, and limiting product offerings. The regulatory cryptocurrency landscape 2024 poses potential consequences for industry sentiment. This highlights the need for strategic adaptation. This is particularly important in response to the development of legal frameworks.

Conclusion

As the crypto industry enters 2024, it navigates a landscape shaped by several key developments. First, the emergence of Spot Bitcoin ETFs in the US has created a significant impact. Second, DeFi is evolving in response to regulatory demand. Third, certain projects are experiencing explosive growth. Finally, there is anticipation surrounding the upcoming bitcoin halving in April 2024. Security remains paramount within the industry. It is important to learn from past exploits to strengthen its foundations. The interplay of regulatory challenges in crypto is notable. Additionally, market dynamics play an important role. Furthermore, technological innovation underscores the resilience and adaptability inherent in the cryptocurrency ecosystem. The future holds promise for the industry. It is dependent on the ability to balance growth effectively. It also depends on maintaining a strong focus on security and compliance.

Read More: