Spot Bitcoin ETFs Surpass $50 Billion in Trading Volume, Bitcoin trading volume today

In a groundbreaking development, recently launched spot bitcoin exchange-traded funds (ETFs) have achieved a remarkable milestone. Spot bitcoin etf volume surpasses 50 billion within few weeks of introduction. This success is attributed to the regulatory approval granted by the Securities and Exchange Commission (SEC). Industry giants such as BlackRock, Fidelity, and Bitwise received these approvals in January. The increase in Bitcoin trading volume reflects growing investor interest and confidence in these regulated investment products. This phenomenon is reshaping the competitive landscape among ETFs. This report explores the driving forces behind this growth. It also analyzes market dynamics and compares key players such as BlackRock and Greyscale. Additionally, it evaluates the recent performance of Bitcoin. Bitcoin trading volume today speculates on the future of crypto ETFs, including the potential of Ethereum ETFs.

Spot Bitcoin ETFs Surpass $50 Billion in Trading Volume: What’s Driving the Surge?

Table of Contents

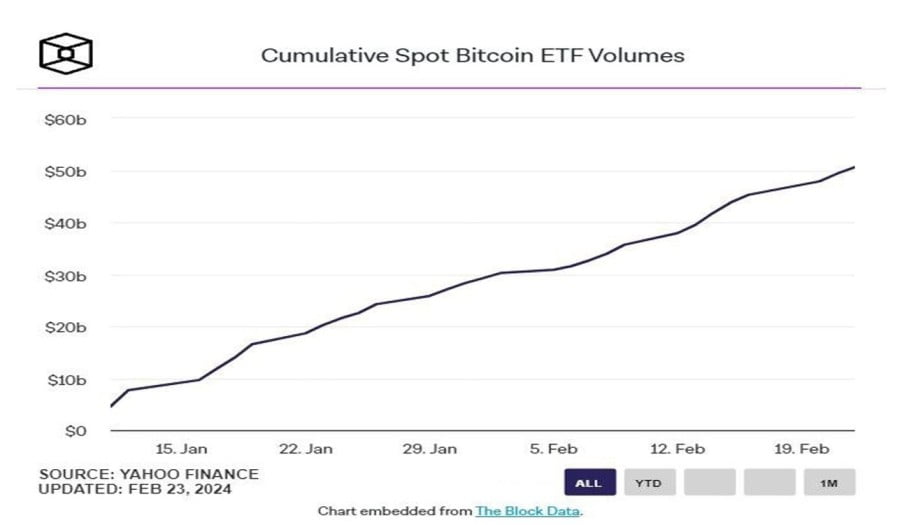

ToggleSpot Bitcoin ETFs have reached an unprecedented milestone. Spot bitcoin ETFs volume surpasses 50 billion. This achievement occurred within six weeks of their launch. The best bitcoin ETF performance can be attributed to the regulatory green light from the SEC. The increase in Bitcoin trading volume today boosts investor confidence in these regulated investment products. In just one month, the volume went from $28.3 billion to $50.5 billion. Competitive dynamics and the market share of Bitcoin ETFs revealed change. Greyscale’s GBTC is witnessing a decline, while BlackRock’s IBIT is gaining ground. Net inflows of Bitcoin ETFs marked a positive trend on Thursday. After a short period of outflows, they reached $251.4 million. Total assets under management (AUM) for spot bitcoin ETFs are close to 300,000 BTC. This indicates a strong growth trajectory.

Bitcoin Price Up 26.5% in February: Is This the Bullish Signal We’ve Been Waiting For?

Despite recent price fluctuations, Bitcoin has shown resilience. It is currently trading at $51,207, reflecting a 26.5% increase for the month. Additionally, it boasts substantial 21% year-to-date growth. This bullish trend is responsible for the increasing adoption of Bitcoin. This is happening in the traditional investment channel through spot bitcoin ETFs. The increase in bitcoin trading volume today for these ETFs has contributed to renewed investor confidence. This is subject to regulatory SEC approval of Bitcoin ETFs. Notably, it saw trading volume of more than $2.5 billion on Tuesday. This further supports the positive sentiment around Bitcoin. Analysts expect the momentum to continue. They are expected to increase further in March.

BlackRock vs. Grayscale: Who’s Winning the Spot Bitcoin ETF Race?

Market share dynamics reveal the changing landscape among spot bitcoin ETFs. The BlackRock IBIT ETF, in particular, has seen substantial growth in market share. The BlackRock IBIT ETF price rose to 37.4% from 22.1%. It is positioning itself as a key beneficiary of these changes. In contrast, Grayscale’s GBTC fell from 50.5% to 28.6%. Competitive dynamics highlight the growing choices of investors. They also emphasize the impact of fee structures on market share. BlackRock’s success underscores the changing dynamics. This is evident in the spot Bitcoin ETF race.

Bitcoin ETFs vs. Traditional Investment: Which Option is Right for You?

As spot bitcoin ETFs gain traction, investors are presented with an alternative path. It provides exposure to the cryptocurrency market. Regulatory SEC approval of Bitcoin ETFs signal growing acceptance of these ETFs. Additionally, the impressive Bitcoin trading volume today contributes to their recognition in traditional investment circles. The report discusses the pros and cons of choosing Bitcoin ETFs over traditional investment options. It considers factors such as liquidity, fees, and market dynamics. Investors are now faced with the decision of whether or not to embrace the innovation of crypto ETFs. Alternatively, they must decide to stick to more conventional investment instruments.

Will Ethereum ETFs Be Next? Experts Predict Crypto ETF Boom

Amidst the success of spot bitcoin ETFs, attention is focused on the potential for ethereum ETFs to enter the market. Experts predict a potential boom in the crypto ETF space. New players are preparing to launch and ride the wave. WisdomTree’s plan to convert its futures-backed products into physical ETFs signals an evolution in the industry. Additionally, Valkyrie’s efforts to improve its infrastructure contribute to this evolving landscape. The report explores the potential and challenges of Ethereum ETFs. It does so considering the success of Bitcoin ETFs. Additionally, it considers the growing demand for various crypto investment options.

Bitcoin Market in 2024: Boom or Bust? Experts Weigh In

As the crypto market matures and Bitcoin ETFs thrive, experts share their insights. They provide an analysis of the likely trajectory of the Bitcoin market in 2024. According to various cryptocurrency news reports, analysts weigh in on the factors influencing the market. These factors include regulatory developments, investor sentiment, and macroeconomic conditions. The report provides a comprehensive view. It considers both optimistic and cautious perspectives. The aim is to help investors navigate the evolving landscape of the cryptocurrency market.

SEC Approves Spot Bitcoin ETFs: Is This a Turning Point for Crypto Regulation?

The regulatory SEC approval of bitcoin ETFs marks a significant milestone. This is within the larger context of crypto regulation. The report examines the impact of this approval. It focuses on the regulatory landscape for cryptocurrencies. Experts and industry insiders provide their perspectives. They focus on whether this signals a turning point in the SEC’s approach. This is specifically related to crypto-related financial products. The approval has undoubtedly boosted the success of spot bitcoin ETFs. However, questions remain about the broader regulatory environment. In particular, there is uncertainty about its impact on the future development of crypto investment products.